Japan Consumer Behavior: The usage of mobile payment service in Japan

日本消費者行為研究: 日本行動支付服務情況分析

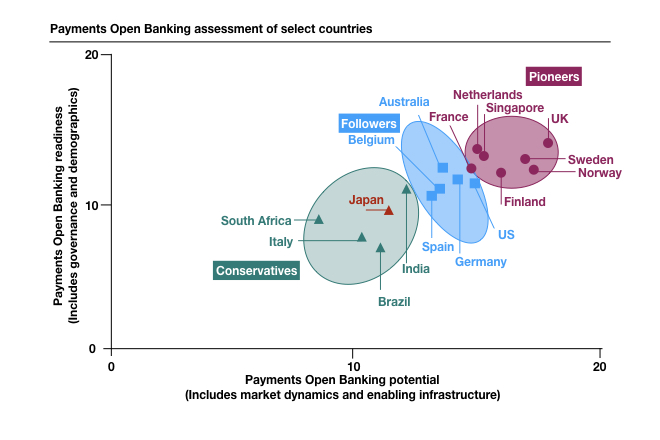

Are you still paying by cash? Or you only bring your smartphone when you go outside, and pay every purchase with your smartphone? This consumer behavior is getting common in most countries, such as Singapore, Sweden, the UK, and Finland, etc. Those governments promote paperless policy successfully. However, Japan as a cash-based country still need some time to get consumers accustomed to the convenience of mobile payment.

你還在使用現金支付嗎? 還是出門只需一隻智慧型手機,就可以完成所有的支付行為? 使用行動支付的現象在各國家已越來越普及,其中先驅的幾個國家例如新加坡、瑞典、英國、芬蘭等,皆成功提倡無紙化政策。 然而,以現金為主的日本還需一段時間讓消費者習慣行動支付所帶來的便利。

▍Capgemini financial services analysis (2019)

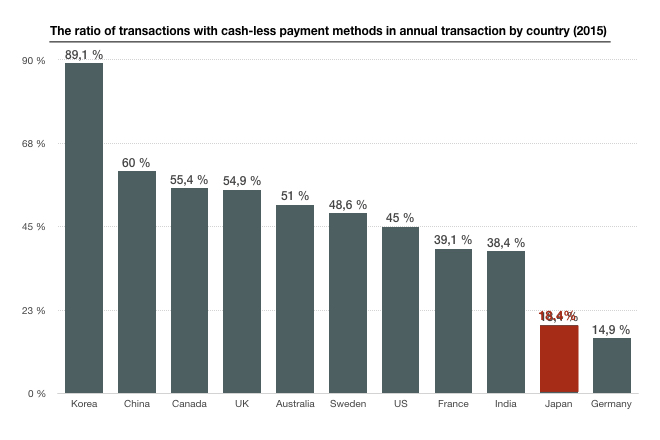

According to the “Future Investment Strategy in 2017”, the Ministry of Economy, Trade, and Industry is eager to expand the mobile payment service in Japan for 40% growth until 2027. The Japanese government said compared to the other countries, the penetration rate of mobile payment method is quite low only 18.4% of the household final consumption expenditure was paid via cashless payment methods, such as credit cards, electronic money, and mobile payment in 2015.

根據未來投資戰略2017的報告,日本經濟產業省期望能在未來10年內將行動支付行為使用率提升40%。根據2015年資料顯示,日本與其他國家相比,在行動支付的普及度上,僅有18.4%會透過信用卡、電子貨幣或是行動支付,在家計最終消費支出中使用。

▍Source form Ministry of Economy, Trade, and Industry (2015)

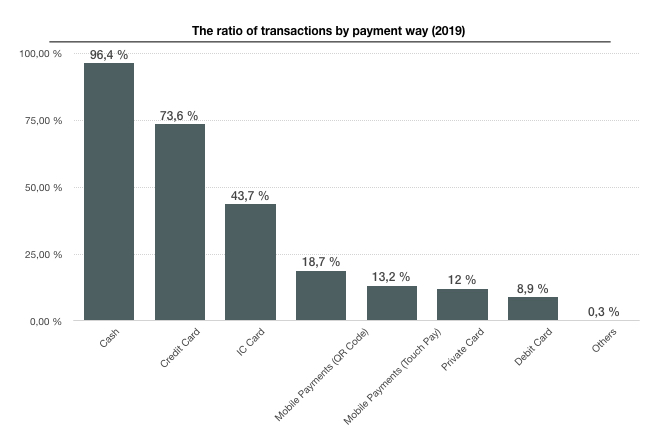

Let’s see how is the situation changed in 2019. According to NEC Solution Vators’s report, there are some points to review in mobile payment behavior. First, the mobile payment method usually uses in small payments of 1,000 yen or less in convenience stores. Cash and credit card are mainly used for medium to high-value payments of 3000 yen or above in supermarkets, department store and online shopping.

緊接著來看2019行動支付市場行為的調查報告。根據報告顯示,日本消費者在使用行動支付行為皆為1000日圓以下等小額付款,並且以便利超商居多。而現金與信用卡則使用於3000日圓以上等高單價消費中,以超級市場、百貨公司或是網路購物為主。

▍Source from NEC Solution Vators (2019)

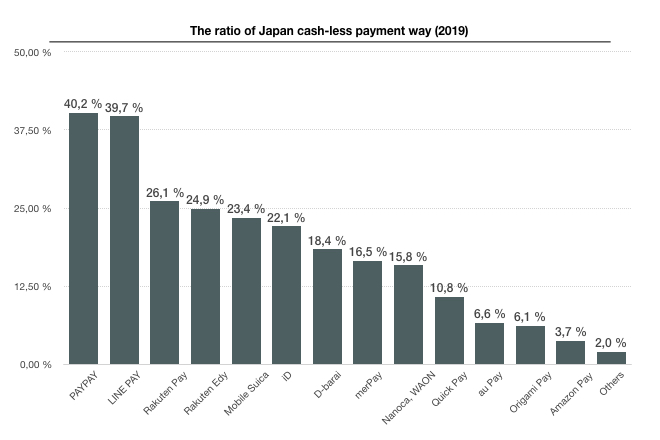

The mobile payment method is much popular in young generation, and it may become a trend in the following years. Young people are getting used to use QR code type and touch type payments way. Such like PayPay and Line Pay which use QR code payment is 40% higher than other mobile payments. In addition, point return is the biggest trigger for people to use mobile payments.

使用行動支付又以年輕族群為主,並且未來將有普及的趨勢。年輕族群在使用QR code與指紋辨識/臉部辨識支付功能較年長者習慣。其中以QR code支付為主的PayPay與Line Pay佔所有行動支付中的40%。此外,點數回饋是消費者使用行動支付的最大誘因。

▍Source from NEC Solution Vators (2019)

According to Yano Research Institue Ltd., the mobile payment market size in Japan is expected to increase from 9 million USD into 40 million from 2017 to 2023 (at the rate of 100 JPY = $0.90 USD)

根據矢野經濟研究所的報告顯示,行動支付市場預計2023年會從9百萬美元增長至4千萬美元。(100日幣=0.9美元)